Unlocking Success: A Comprehensive Guide to Forex Trading Business

The Forex trading business represents one of the most dynamic and lucrative markets in the world. With a daily trading volume of over $6 trillion, it is essential for both novice and seasoned investors to understand the mechanisms behind currency exchange. In this guide, we will explore the fundamental aspects of Forex trading, including market dynamics, trading strategies, risk management, and tips for creating a successful trading journey. For those interested in exploring Indian trading platforms, consider checking out forex trading business Indian Trading Platforms.

What is Forex Trading?

Forex, or foreign exchange, refers to the global marketplace where currencies are traded. Unlike stock exchanges that operate within fixed hours, Forex trading occurs 24 hours a day, five days a week. This continuous market enables traders to enter and exit positions anytime, making it accessible to global participants.

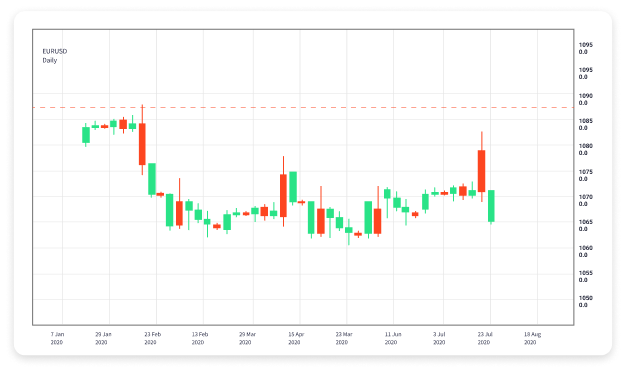

The primary objective of Forex trading is to make profits by speculating on the fluctuation of currency pairs. For example, if you believe that the Euro (EUR) will strengthen against the USD (United States Dollar), you would buy the EUR/USD pair. Conversely, if you think the Euro will weaken, you would sell the pair.

Understanding Currency Pairs

In Forex trading, currencies are always quoted in pairs. Each pair consists of a base currency and a quote currency. The base currency is the first currency listed, while the second currency is the quote currency. For example, in the pair EUR/USD, the Euro is the base currency, and the USD is the quote currency.

The value of a currency pair represents how much of the quote currency is required to purchase one unit of the base currency. This pairing system allows traders to speculate on the relative strength of one currency against another, understanding that their values are interconnected due to various economic factors.

Market Participants

The Forex market comprises various participants, each playing a unique role:

– **Central Banks**: These institutions manage national currencies and influence exchange rates through monetary policy.

– **Financial Institutions**: Banks and investment firms trade currencies for profit, managing large volumes of foreign exchange.

– **Corporations**: Businesses involved in international trade require Forex to pay for goods and services in foreign currency.

– **Retail Traders**: Individual investors and traders engage in the Forex market to speculate on currency movements, using online trading platforms.

Developing a Trading Strategy

A solid trading strategy is essential for success in Forex trading. Here are key components to consider when developing your approach:

1. **Market Analysis**: Understanding market conditions through technical analysis (chart patterns, indicators) and fundamental analysis (economic data, geopolitical events) helps traders make informed decisions.

2. **Timeframes**: Different trading styles, such as day trading, swing trading, and scalping, use various timeframes to enter and exit trades. It’s essential to select a style that aligns with your personality and availability.

3. **Risk Management**: Use risk management strategies like stop-loss orders to protect your capital. Always define how much you’re willing to lose on a trade, and adjust your position sizes accordingly.

4. **Continuous Learning**: The Forex market is ever-evolving, so ongoing education is vital. Follow market news, participate in seminars, and consider using demo accounts to practice strategies without financial risk.

Choosing the Right Trading Platform

Selecting a reliable trading platform is critical for effective Forex trading. Here are factors to consider:

– **Reputation**: Choose platforms with a good track record and positive reviews from traders.

– **Fees and Commissions**: Evaluate the cost of trading on the platform, including spreads, commissions, and withdrawal fees.

– **User Experience**: A user-friendly interface with robust tools and features will enhance your trading experience.

– **Customer Support**: Good customer service is essential for resolving any issues promptly.

In addition, ensure that the platform you choose complies with regulations set by financial authorities to protect your investments.

The Importance of Risk Management

Effective risk management is the cornerstone of successful Forex trading. Implementing strategies to minimize losses is just as important as pursuing profits. Here are some common risk management techniques:

– **Position Sizing**: Determine the appropriate amount of capital to risk on each trade. A common rule is to risk no more than 1-2% of your trading capital on a single trade.

– **Diversification**: Avoid putting all your capital into one currency pair. Diversifying across multiple trades can reduce risk exposure.

– **Use of Leverage**: Leverage can amplify profits but also increases risk. Use leverage cautiously and understand the implications before utilizing it in your trading.

By prioritizing risk management, traders can establish resilience and longevity in the competitive Forex market.

Emotional Discipline: The Trader’s Mindset

Emotional discipline is crucial in Forex trading. Traders must cultivate a mindset that allows them to follow their strategies without becoming overly influenced by greed or fear. Here are tips for maintaining emotional control:

– **Set Realistic Goals**: Establish achievable trading goals based on your skill level and market conditions rather than unrealistic expectations.

– **Keep a Trading Journal**: Documenting trades, thoughts, and emotions will help identify patterns and improve decision-making over time.

– **Practice Patience**: Avoid impulsive trades. Wait for setups that align with your strategy and trust in your analysis.

Following these principles can help traders maintain control over their emotions during high-pressure situations, ultimately leading to more consistent results.

Conclusion

The Forex trading business offers immense opportunities for those willing to learn and adapt. By understanding the fundamentals of the market, developing a robust trading strategy, managing risk, and cultivating emotional discipline, traders can maximize their chances of success. As the landscape of Forex trading continues to evolve, keeping up with the latest trends and best practices will empower you to navigate this exciting financial market confidently.